Car Data Analysis

Analysis of the Three Charts

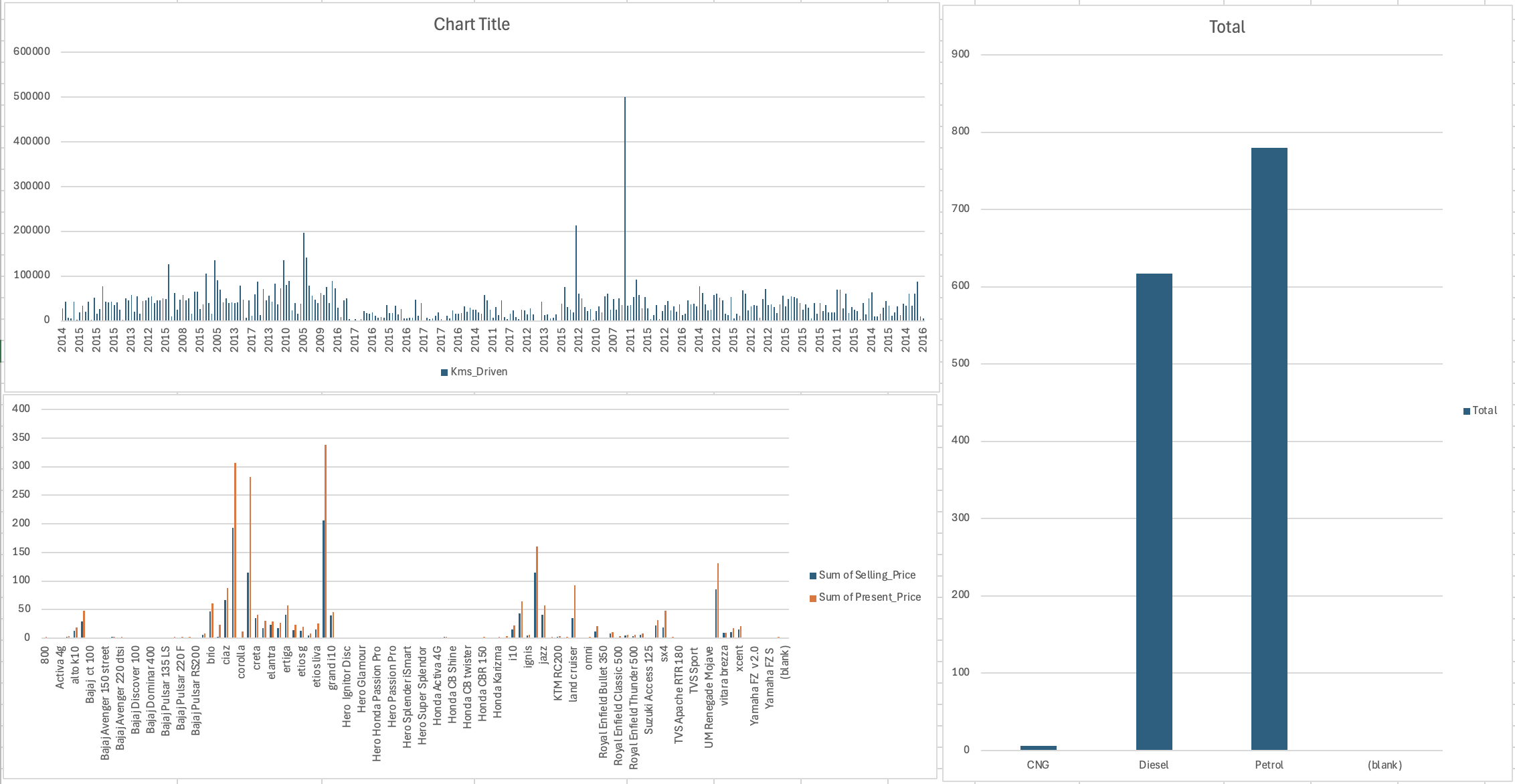

1. Top Left Chart: Yearly Sum of Kilometers Driven

- This chart provides insight into the cumulative distance driven across all vehicles for each year.

- The trend is highly irregular, with notable peaks and troughs. Some years show significantly higher total mileage, possibly due to a large number of vehicles being included in the dataset for those years.

- There are a few years with extreme spikes in kilometers driven, suggesting that some vehicles in those years have exceptionally high mileage.

- The dataset might include a mix of newer and older cars, meaning some years could appear inflated due to older vehicles with accumulated miles being accounted for.

- If the peaks correspond to older vehicles, this could suggest that buyers in those years purchased used cars with higher mileage rather than new cars.

2. Bottom Left Chart: Selling Price vs. Present Price Across Car Models

- This chart provides a direct comparison between the sum of selling prices (blue) and sum of present prices (orange) for various car models.

- For almost all models, the sum of present prices is higher than the sum of selling prices, which makes sense because cars depreciate in value over time.

- Certain models show significant gaps between the present price and the selling price, indicating vehicles that retain their value better than others.

- Some models, particularly well-known ones, show higher selling prices, which might suggest higher demand in the second-hand market.

- If there are models where the selling price is close to the present price, it could indicate that these models are either newer (not much depreciation yet) or have strong resale value.

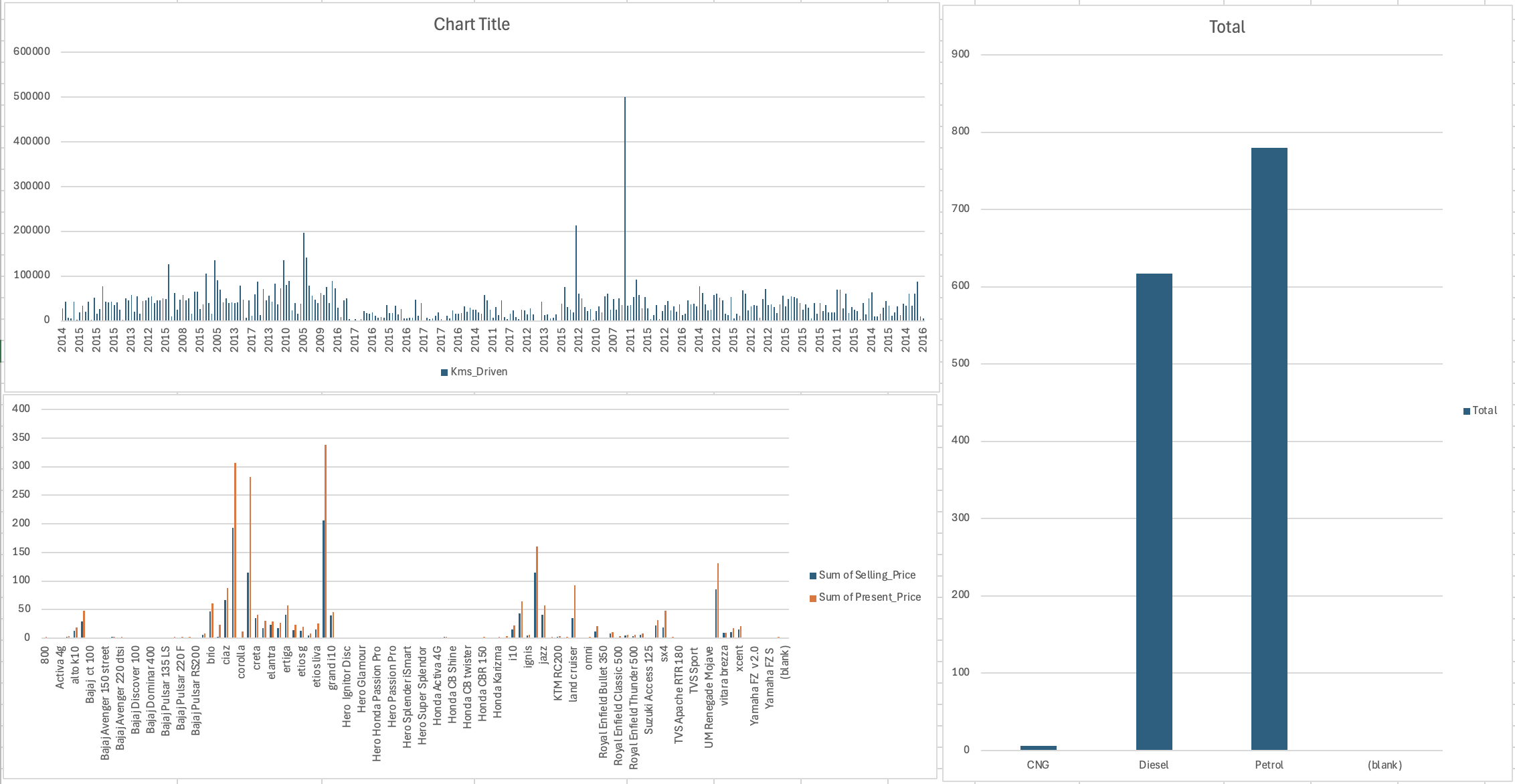

3. Right Chart: Comparison of Total Selling Price by Fuel Type

- This chart compares the total selling price of Diesel, Petrol, and CNG cars in the dataset.

- Petrol cars have the highest total selling price, followed by Diesel cars, with CNG cars having a negligible total selling price.

- This could indicate that petrol cars dominate the dataset, either due to higher availability or greater demand in the second-hand market.

- Diesel cars, despite having lower total selling prices than petrol, still hold significant value, suggesting they are also widely traded.

- The low total selling price of CNG vehicles could mean either that there are fewer CNG vehicles in the dataset or that CNG cars depreciate more quickly than their petrol/diesel counterparts.

Key Takeaways & Arguments

1. Depreciation Insights

- Most cars experience a significant drop in value from their present price to their selling price, highlighting depreciation as a key factor in second-hand car transactions.

- Certain car models retain their value better than others, making them better investments in the used car market.

2. Market Demand for Fuel Types

- Petrol cars seem to dominate the market in terms of selling price, potentially due to greater availability or preference among buyers.

- Diesel cars also hold considerable resale value, likely due to their fuel efficiency and durability.

- CNG cars have low representation, which may suggest a niche market or lower resale demand.

3. Mileage Trends & Used Car Market

- The top left chart shows that certain years have a much higher cumulative mileage. This could indicate that the second-hand market sees more transactions of older, high-mileage vehicles during those years.

- If high-mileage cars are frequently resold, it could indicate that buyers in the used car market are willing to compromise on mileage in exchange for lower prices.

4. Investment Decisions

- If choosing between different fuel types, petrol cars might be the safest investment due to their strong resale presence.

- Some specific models appear to retain their value better, making them good choices for resale.

Car Data Table (first 50 rows)

ritz

2014

3.35

5.59

27000

Petrol

Dealer

Manual

0

sx4

2013

4.75

9.54

43000

Diesel

Dealer

Manual

0

ciaz

2017

7.25

9.85

6900

Petrol

Dealer

Manual

0

wagon r

2011

2.85

4.15

5200

Petrol

Dealer

Manual

0

swift

2014

4.6

6.87

42450

Diesel

Dealer

Manual

0

vitara brezza

2018

9.25

9.83

2071

Diesel

Dealer

Manual

0

ciaz

2015

6.75

8.12

18796

Petrol

Dealer

Manual

0

s cross

2015

6.5

8.61

33429

Diesel

Dealer

Manual

0

ciaz

2016

8.75

8.89

20273

Diesel

Dealer

Manual

0

ciaz

2015

7.45

8.92

42367

Diesel

Dealer

Manual

0

alto 800

2017

2.85

3.6

2135

Petrol

Dealer

Manual

0

ciaz

2015

6.85

10.38

51000

Diesel

Dealer

Manual

0

ciaz

2015

7.5

9.94

15000

Petrol

Dealer

Automatic

0

ertiga

2015

6.1

7.71

26000

Petrol

Dealer

Manual

0

dzire

2009

2.25

7.21

77427

Petrol

Dealer

Manual

0

ertiga

2016

7.75

10.79

43000

Diesel

Dealer

Manual

0

ertiga

2015

7.25

10.79

41678

Diesel

Dealer

Manual

0

ertiga

2016

7.75

10.79

43000

Diesel

Dealer

Manual

0

wagon r

2015

3.25

5.09

35500

CNG

Dealer

Manual

0

sx4

2010

2.65

7.98

41442

Petrol

Dealer

Manual

0

alto k10

2016

2.85

3.95

25000

Petrol

Dealer

Manual

0

ignis

2017

4.9

5.71

2400

Petrol

Dealer

Manual

0

sx4

2011

4.4

8.01

50000

Petrol

Dealer

Automatic

0

alto k10

2014

2.5

3.46

45280

Petrol

Dealer

Manual

0

wagon r

2013

2.9

4.41

56879

Petrol

Dealer

Manual

0

swift

2011

3

4.99

20000

Petrol

Dealer

Manual

0

swift

2013

4.15

5.87

55138

Petrol

Dealer

Manual

0

swift

2017

6

6.49

16200

Petrol

Individual

Manual

0

alto k10

2010

1.95

3.95

44542

Petrol

Dealer

Manual

0

ciaz

2015

7.45

10.38

45000

Diesel

Dealer

Manual

0

ritz

2012

3.1

5.98

51439

Diesel

Dealer

Manual

0

ritz

2011

2.35

4.89

54200

Petrol

Dealer

Manual

0

swift

2014

4.95

7.49

39000

Diesel

Dealer

Manual

0

ertiga

2014

6

9.95

45000

Diesel

Dealer

Manual

0

dzire

2014

5.5

8.06

45000

Diesel

Dealer

Manual

0

sx4

2011

2.95

7.74

49998

CNG

Dealer

Manual

0

dzire

2015

4.65

7.2

48767

Petrol

Dealer

Manual

0

800

2003

0.35

2.28

127000

Petrol

Individual

Manual

0

alto k10

2016

3

3.76

10079

Petrol

Dealer

Manual

0

sx4

2003

2.25

7.98

62000

Petrol

Dealer

Manual

0

baleno

2016

5.85

7.87

24524

Petrol

Dealer

Automatic

0

alto k10

2014

2.55

3.98

46706

Petrol

Dealer

Manual

0

sx4

2008

1.95

7.15

58000

Petrol

Dealer

Manual

0